self employment tax deferral turbotax

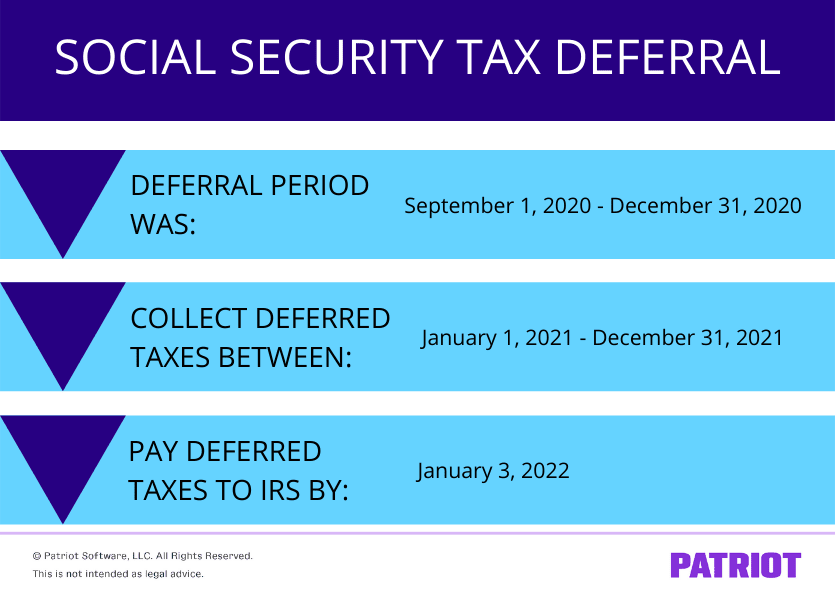

Available for employers and self-employed. The option to defer only applies to Social Security taxes for self-employment income you earned from March 27 2020 through December 31 2020.

Self Employed Turbo Tax Bundle

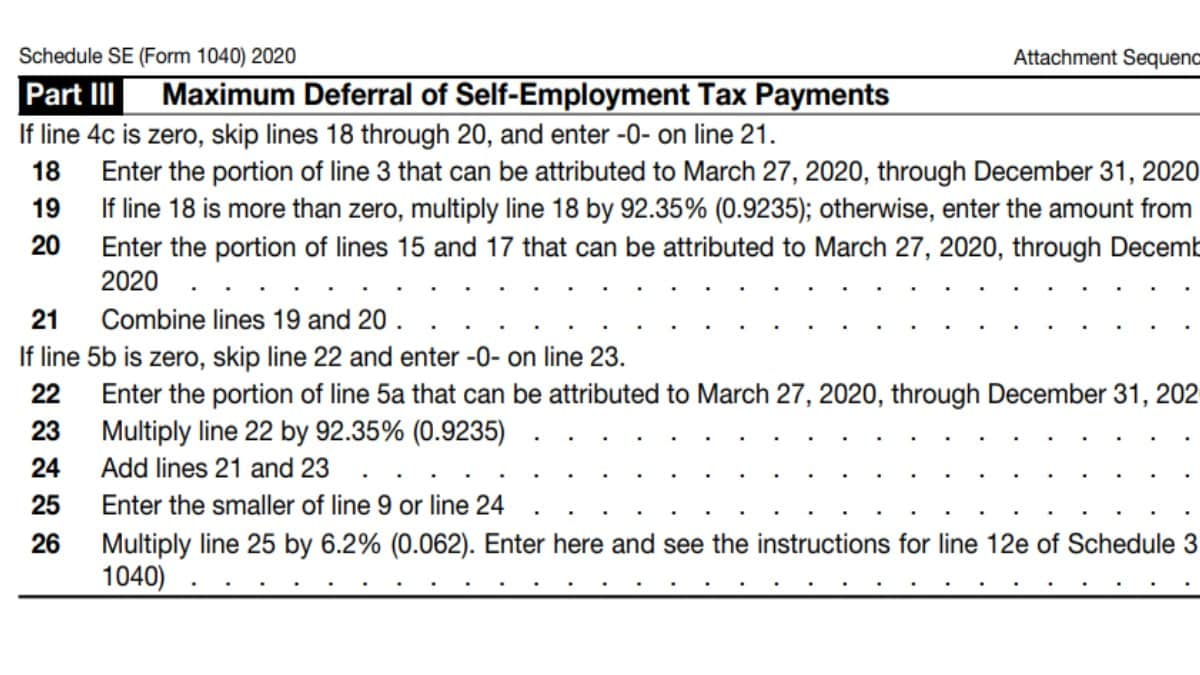

Line 18 is for the total.

. According to the maximum deferral of self-employment tax payments that TurboTax supports the SE-T is a self-employment taxpayer form. However the credit you may be seeing is half of your self-employment tax that is. Tax Credit Estimator More money in your pocket.

How a payroll tax relief deferral may help self-employed people In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self. You are allowed to deduct 50 of what you pay in self-employment tax as an income tax deduction on Form 1040. I would assume that they will handle it appropriately.

Estimate how much cash you can get from ERC paid leave and a tax deferral. Half of the deferred social security tax is due by december 31 2021 and the remainder is due by december 31 2022. This income is typically.

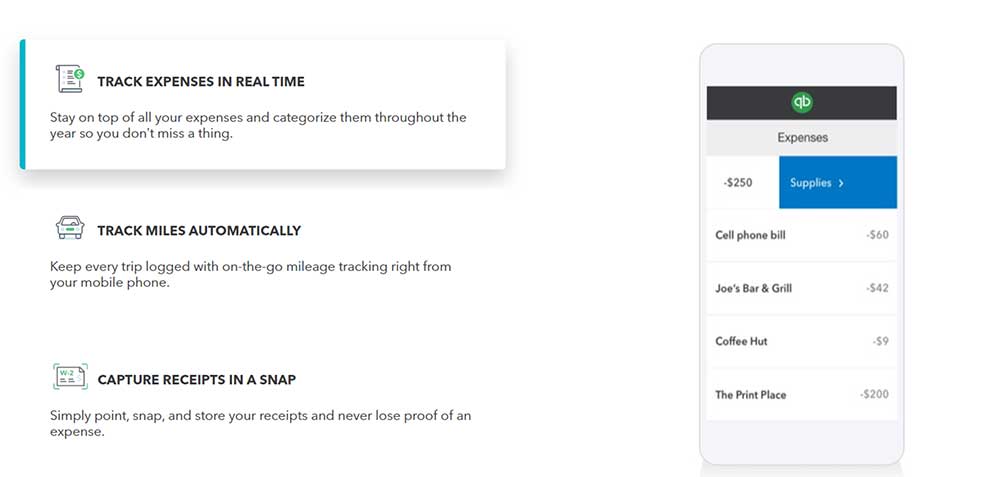

If the 2020 tax return had a self employment tax deferral amount to be paid later. You can delete your election to defer your self-employment taxes from your tax return. Perfect for independent contractors and small businesses.

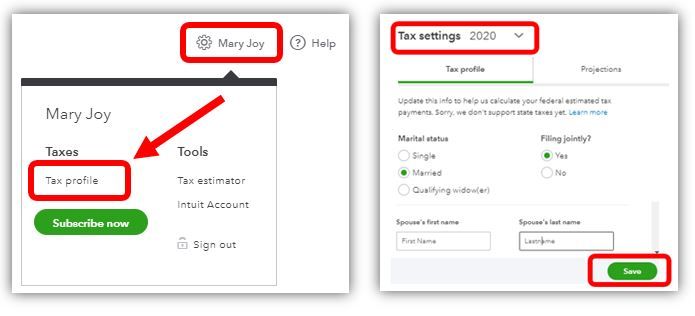

Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years. Deferral Of Self Employment Tax Turbotax. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms.

However when you are filling out your 1040 the IRS allows you to deduct a portion of the self-employment tax payments you make as an adjustment to income. Since TurboTax is trying to calculate a tax deferral payment for self-employment tax then you need to go back into that section of your return and enter that you want 0 self employment tax. This deduction is available whether or not you.

After it is paid should an entry be made into TurboTax 2021 as an estimated tax entry for the. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete.

2021 Instructions For Schedule H 2021 Internal Revenue Service

10 Key Tax Deductions For The Self Employed

Solved Turbotax Is Trying To Calculate A Tax Payment Deferral For Self Employment Taxes But I M Getting A Refund It S Stuck In A Loop How Do I Get It To Stop

The Self Employment Tax Turbotax Tax Tips Videos

Employee Social Security Tax Deferral Repayment Process

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Self Employment Tax Deductions Optimize Your Tax Return

Get To Know The New Tax Code While Filling Out This Year S 1040 The New York Times

How To File Taxes As A Blogger With Free Turbotax Self Employed Giveaway

Tax Reform How Physicians And The Self Employed Are Affected Physician On Fire

What You Need To Know About Self Employment Tax Deferral Taxes For Expats

Form 1099 Nec For Nonemployee Compensation H R Block

4 Best Tax Software Of 2022 Reviewed

Retirement Moves To Help Slash Your Tax Bill Forbes Advisor

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Self Employed Use These Deductions To Save Thousands At Tax Time

Payroll Tax Delay Coronavirus Small Business Relief Smartasset

Hello Everyone I M Filing My Taxes For 2020 With Turbotax And They Are Asking Me To Check This Entry I Don T Really Understand What I Should Put Here R Tax